Understanding Black Tax and Its Challenges

Black tax is a common financial obligation where working adults provide monetary support to their extended family, including parents and siblings. This cultural expectation, prevalent in many African communities, often places a heavy financial burden on individuals striving to balance family support with personal financial goals. The challenge lies in managing these responsibilities sustainably without compromising one's financial wellbeing.

The first step to managing black tax positively involves setting clear financial boundaries and engaging in open communication with family members about what support can realistically be offered. Educating the family about one's financial limits can help reduce unrealistic demands and alleviate stress. Prioritizing personal financial health alongside family obligations is essential to break the cycle of financial strain.

Key Facts about Black Tax

- Black tax refers to ongoing financial support given to extended family members after achieving employment or financial success (Daily Nation).

- It can include paying for siblings’ education, parents’ living expenses, and community projects (Murimi Daniel).

- Emotional factors such as guilt or ego often perpetuate this financial dependency, increasing user stress (Murimi Daniel).

- Breaking the burden requires strategic financial planning, prioritizing personal goals, and establishing clear limits (Daily Nation).

- Positive management emphasizes giving that empowers recipients through education and skills development rather than unconditional cash handouts (Murimi Daniel).

How Wavvy Wallet Supports Managing Black Tax

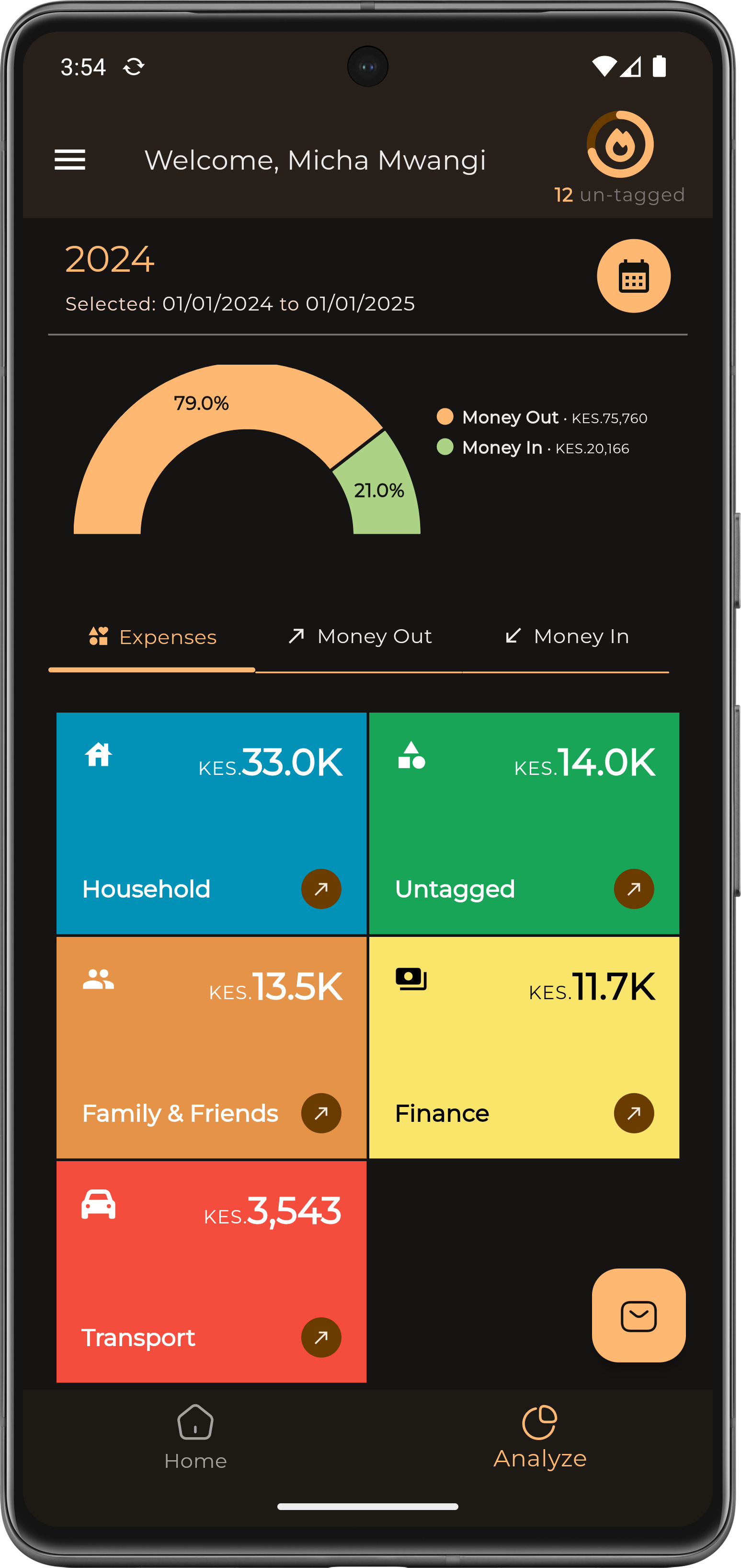

Wavvy Wallet serves as a powerful tool to help users manage black tax effectively. This AI-powered M-PESA expense tracker automatically categorizes transactions, giving clear insights into spending patterns. By tracking and budgeting expenses related to both personal and family financial support, users can plan their finances deliberately.

The app enables setting distinct budget categories including black tax obligations, which helps segregate family support funds from personal expenses. With detailed reports and spending summaries, users gain better control, reducing overspending and avoiding financial stress associated with black tax.

Additionally, Wavvy Wallet supports financial inclusion by helping users without traditional bank accounts to manage money efficiently. Its strong privacy measures ensure that financial data stays secure on users' devices, fostering trust and confidence.

Wavvy Wallet Features Beneficial for Black Tax Management

- Automatic categorization of M-PESA transactions to track money flow (Wavvy Wallet).

- Allows users to create budgets and allocate specific amounts for black tax expenses (Wavvy Wallet).

- Offers insights on spending habits via charts and summaries to promote informed financial decisions (Wavvy Wallet).

- Secures financial data locally on the device, protecting user privacy (Google Play Store).

- Free basic features available with options to upgrade for advanced analytics and goal tracking (Wavvy Wallet).

Positive Ways to Manage Black Tax

To deal with black tax in a positive way, practical strategies are essential. Firstly, setting financial boundaries that are communicated clearly to family helps manage expectations. Incorporating black tax into budgeting as a planned expense avoids sudden financial shocks.

Secondly, focusing on supporting initiatives that empower family members, such as education or business skills development, creates long-term benefits and reduces dependency. Thirdly, maintaining a balance by prioritizing immediate family and personal savings preserves financial health and future security.

Using tools like Wavvy Wallet enhances financial discipline and awareness, enabling users to track obligations and progress toward savings goals. This approach fosters a sustainable plan to meet black tax responsibilities without sacrificing personal wellbeing.